The 50-30-20 Budgeting Method: What It Is and How to Use It

If you’re new to budgeting, figuring out how to manage your money can feel overwhelming. And, with countless budgeting apps and worksheets available it can seem like a daunting task even knowing which method to choose.

If you don't know where to start, TFNB offers an interactive budgeting tutorial that can help. Whether you are just starting college, nearing retirement, or somewhere in between, our budgeting tutorial will help you understand where your money is going and provide you with actionable steps to manage your finances in the future.

In it, we go over one of the most popular budgeting methods around: the 50-30-20 rule. It's a simple, yet flexible method that divides your income into three different buckets: 50% on needs, 30% on wants, and 20% on savings and debts.

https://www.tfnbtx.com/wp-content/uploads/2023/02/TFNB_50-30-20.https://www.tfnbtx.com/images/mp4

Let's take a closer look at each of the buckets and how the 50-30-20 budgeting rule works in action.

50% of Your Income Should Go Towards Necessities

The 50-30-20 rule says you should spend about half of your paycheck on necessities. Setting aside half of your income may seem high, but once you consider everything that falls into this bucket it begins to make a bit more sense. In general, these are things you can't live without or bills that you can't avoid paying and includes the following:- Housing

- Groceries

- Internet and phone costs (although some people consider this a want, we think it's essential in this day and age)

- Utilities

- Health insurance

- Transportation;

- And minimum debt payments

30% of Your Income Can Go Towards Wants

Think of wants as desires: things we can live without (even if we don't want to). The 50-30-20 rule allows you to spend 30% of your paycheck on these nice-to-haves, and typically includes the following:- Concerts

- Subscriptions

- Travel

- Dining out

- Upgrades

- Shopping sprees;

- And generally, any other sort of fun extra expenditure.

20% of Your Income Should Go Towards Savings

The 50-30-20 rule says to allocate 20% of your paycheck towards savings. You should think of this category as a way to reach your future financial goals, whether that may mean reaching financial freedom from debt, having plenty of rainy-day funds if you lose your job, or establishing a healthy nest egg for a stress-free retirement. For many people, this includes:- Building emergency savings

- Investments

- Retirement funds

- College funds;

- And paying off debt (Not making minimum payments, but making additional principal payments, like adding an additional $50 to your credit card payment.)

The 50-30-20 Rule In Action

Now that you understand how the 50-30-20 rule works, it's time to crunch the numbers.Step One: Calculate Your Income

First, you need to get clear about how much money is coming in each month. This is your monthly income after taxes, or how much hits your bank account each pay period. Check out our budgeting calculator to see how your monthly income fits within the 50-30-20 framework. An example should help bring this concept to light. Let's say you bring in $5,000 a month. Using the 50-30-20 rule, $2,500 should go to needs, $1,500 to wants, and $1,000 to savings and paying down debt.Step Two: Categorize Your Spending

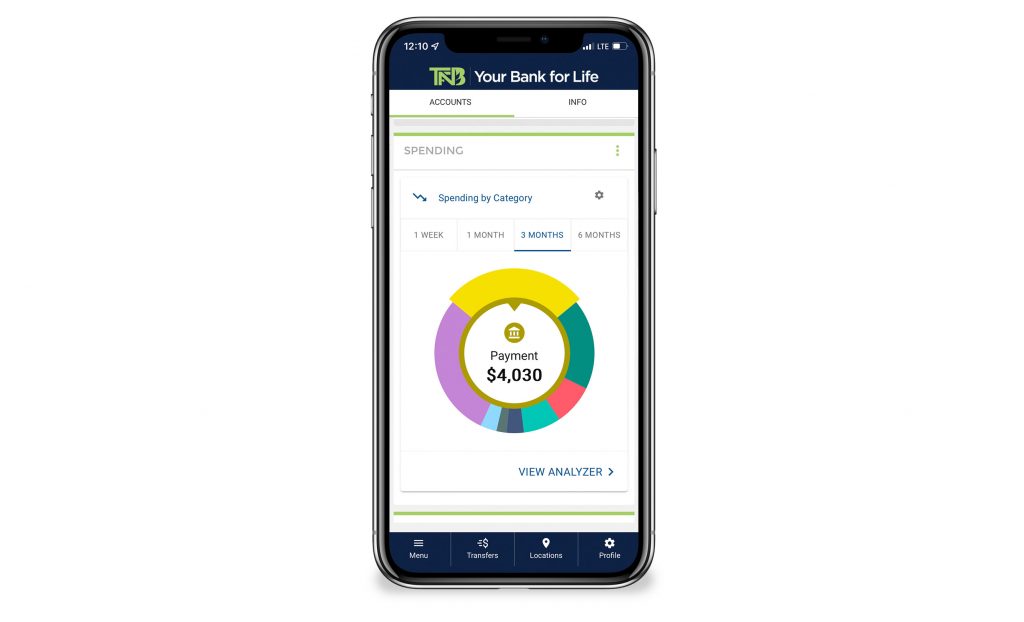

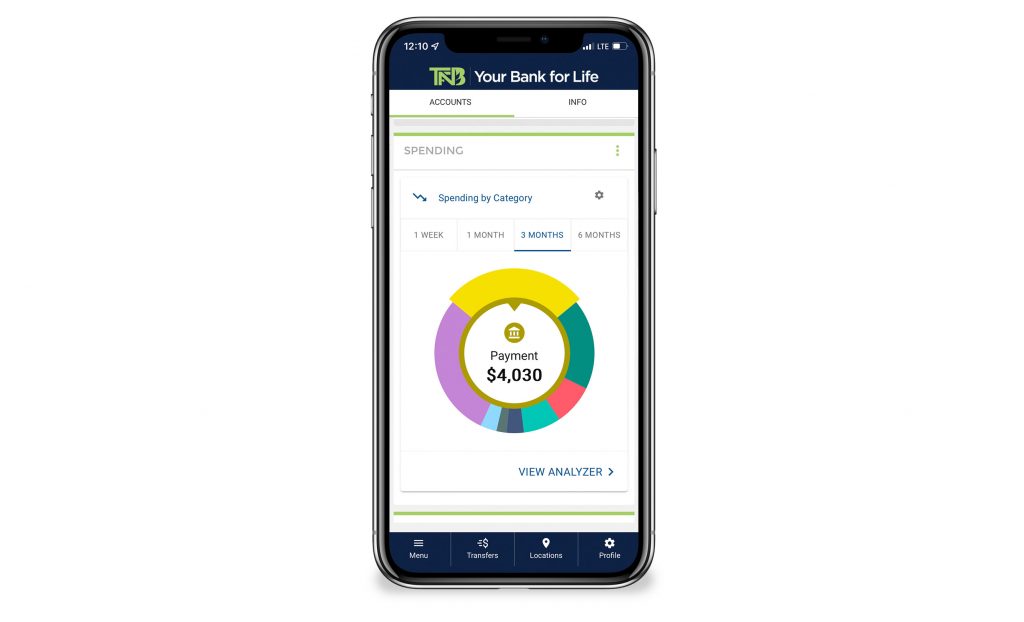

Next, you'll need to gather some of your financials from the last few months and place them into the appropriate spending categories. TFNB’s mobile app (available for Apple and Android devices) automatically categorizes your transactions and makes it easy to get a good snapshot of where your money is going.

Step Three: Take a Hard Look At Your Spending and Adjust

Take a look at the cost of your essentials. Are you spending more than 50%? If so, by what percentage are you going over? Once you know how much is needed for essentials, add it to the 20% that's going towards your savings. (Remember, the point of budgeting is to reach your long-term financial goals, so the savings category is non-negotiable). For example, if essentials are consuming 60% of your monthly income, then savings and essentials combined would be 80%, which now leaves you with 20% for your wants. When you're first starting on your 50-30-20 budget, you might not get to spend 30% of your income on fun things right away—especially if you're just starting your career or hit financial hardship. But, that's the beauty of the 50-30-20 rule. It allows you to modify your budget until you earn more money or find more saving opportunities, so you can eventually hit that golden ratio of 50-30-20.

TFNB Makes the 50-30-20 Rule Easy

Ready to tackle your budget? At TFNB, we offer all the tools to make implementing the 50-30-20 rule easy. With our online banking tools, you can set up automatic transfers from your checking to your savings account, so you can set money aside and watch your savings add up. If you need more resources about budgeting, visit our Financial EDGE Academy. Or even better, drop by any TFNB location during lobby hours to talk with a friendly TFNB banker about how you can put a budget together and reach your long-term financial goals.If you have any questions or would like to know more about our banking solutions, contact us at 254-840-2836

Learn MoreShare On