7 Clever Budgeting Tips For College Students That Actually Work

College isn't just about what you learn in the classroom. It's also the time a lot of people get their first crash course in budgeting and finances.

Managing your funds during your college years can be especially challenging. Between tuition, textbooks, and rent, there's a lot you suddenly have to take on as you get your first taste of financial independence.

Fortunately, with a little planning, it's easy to take charge of your finances (even if you're working on a shoestring budget).

Here are seven college budgeting tips that will save you money, keep your checking account healthy, and help you establish good financial habits for the rest of your adult life.

Tip #1: Know Your Cash Flow

Whether you have a part-time job, receive help from your parents or scholarships—or all of the above—figuring out how much money flows in and out every month is the first step in creating a college budget.

If you already have an online checking account set up with TFNB, you can easily log in and calculate your monthly income. Understanding how much money you're receiving every month is essential and sets the foundation for how much you can afford to spend on essentials or recreational fun.

Tip #2: Understand Your Expenses

It’s important to keep track of how much you’re spending, and what you’re spending it on. The next step in creating a college budget is to identify all of your monthly costs and break them down into fixed expenditures and miscellaneous expenses.

Fixed expenditures are the necessities. For a college student, these expenses may include:

- Rent

- Bills

- Tuition

- Books

- Transportation

- Debt payments

- Insurance

- Internet

- Groceries

Miscellaneous expenses are the kind of expenses that you can live without (even if you would rather not). These may include:

- Subscriptions

- Clothing

- Vacations

- Concerts

- Restaurants

Identifying your monthly spending categories and amounts is the easiest way to get a clear picture of your college student budget. Plus, it allows you to easily make adjustments if needed.

If monthly expenses are creeping dangerously close to your monthly income, you can look at your spending categories to see what costs you can remove. Let's say, your tuition or rent goes up. These fixed expenses are harder to negotiate, but you can, however, cancel a subscription or cut back on dining out to make sure you have enough funds for the necessities.

Tip #3: Set Aside Savings For a Rainy Day

Once you have your monthly income and expenses tallied up, set aside a portion of your budget for savings.

As you enter the "real world," you'll soon realize that life doesn't always go as planned. A roommate might unexpectedly move out, leaving you with a bigger chunk of rent to pay. Or, your car might suddenly break down, leaving you with a hefty repair bill.

Having an emergency fund for life's unexpected expenses can help reduce the stress and cost of these events. With every check they receive—whether it comes from an employer or parents—college students should ideally deposit at least 10% into a savings account.

Tip #4: Starting Building Your Credit (And Factor it Into Your Budget)

College is a great time to start building credit and boosting your score, as long as you go about it the right way.

One of the easiest ways to build credit is with a credit card but choose wisely. Many companies prey on college students and new borrowers with lower credit scores. During your research, you'll want to pay close attention to:

- Fees

- Interest rates

- Incentives

TFNB's VISA® College Real Rewards Card is an excellent option for someone looking to build their credit history. There is a zero percent introductory Annual Percentage Rate (APR) for the first six billing cycles. Plus, you can redeem your points for cash back, which is handy for paying rent or saving on a spring break trip.

But, go easy with the plastic. If you want to establish credit with a credit card, don’t use it unnecessarily, and don't sign up for more than one until you're at a place where you can handle that financial responsibility. Instead, use your card to pay for one type of fixed expense each month (like gas or water bills).

In general, you should strive to keep your credit balance low and factor in any credit card payments into your monthly budget. Also, you should consider setting up automatic payments so that you never miss a payment, which can negatively impact your credit score.

Tip #5: There's An App For That

Some people like to create spreadsheets or use pen and paper to track their finances. But, as a college student you'll already have plenty of homework, so why not let technology do the number crunching for you?

There are plenty of apps that help you keep track of your finances, but if convenience is the name of the game, the best way to keep track of your budget is directly through your bank.

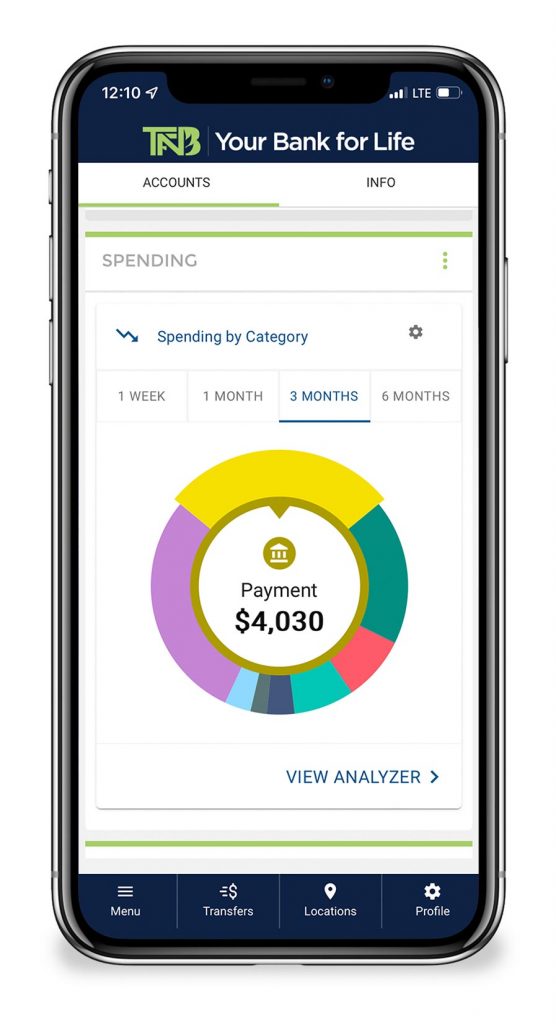

TFNB’s budgeting tool (available for Apple and Android devices) makes it easy to see the big picture of your financial situation. The app provides an overview of your banking, retirement, and credit card accounts all in one place, calculates your net worth, and automatically categorizes your transactions so you can easily identify spending habits without ever having to tackle a spreadsheet. Plus, it gives you the ability to create different goals to save toward, like a spring break trip or a new laptop.

College life is hectic, so there's no need to monitor your finances daily. But, make sure you set aside some time at least once a month to review your money situation. Chances are, after consistently using a helpful budgeting tool for just a month, you’ll find new ways to save.

Tip #6: Always Ask If There's a Student Discount

You're already paying for college, so you might as well take advantage of the perks of being a student while you can.

Many businesses beyond movie theaters offer student discounts but don't always advertise them. Don't be afraid to ask businesses about discounts, and always keep your student I.D. on hand if they do.

Also, don't forget to check for student discounts when you're shopping online. You can usually verify that you're a student by entering your school email address when you complete your order.

Tip #7: Avoid Buying New Books (If You Can)

Books are a necessity for any student. Unfortunately, college textbooks can be pretty pricey with some costing hundreds of dollars. Always buy used textbooks whenever you can, and sell back any books you won’t need anymore to student bookstores to help minimize some of the cost. When you buy used instead of new, you'll save dollars and trees!

TFNB—Your Bank For College and Beyond

Cramming for exams can be stressful, but managing your money in college doesn't have to be. By following the above tips, you'll be able to enjoy your college days and have a strong financial foundation for the future.

Need more tips? Check out our other budgeting resources, or speak to a team member at TFNB. Whether you're ready to open up a checking account or simply want to talk to someone about your financial situation, we're here to help—now and in the future. That is why we’re Your Bank For Life.

If you have any questions or would like to know more about our banking solutions, contact us at 254-840-2836

Learn MoreShare On